Who should Attend

Anyone interested in valuation

Portfolio Managerswho are interested in the effects of corporate restructuring on firm value, and the implications for portfolio management.

Analysts involved in mergers and acquisitions, who would like to acquire a wider repertoire of valuation skills.

Corporate financial officers, who want to understand the details of valuation, either because they are planning acquisitions or are interested in value enhancement strategies for their firms.

Equity research analysts, who are interested in examining alternatives to the multiples that they use or the linkage to discounted cash flow models.

The mix of basic valuation techniques & applications provided in this seminar will appeal to a widely diverse audience.

Why should Attend

- Value any kind of firm in any market, using discounted cash flow models (small and large, private and public)

- Value a firm using multiples and comparable firms.

- Analyze and critique the use of multiples in valuation.

- Value “problem” firms, such as financially troubled firms and start – up firms.

- Estimate the effect on value of restructuring a firm.

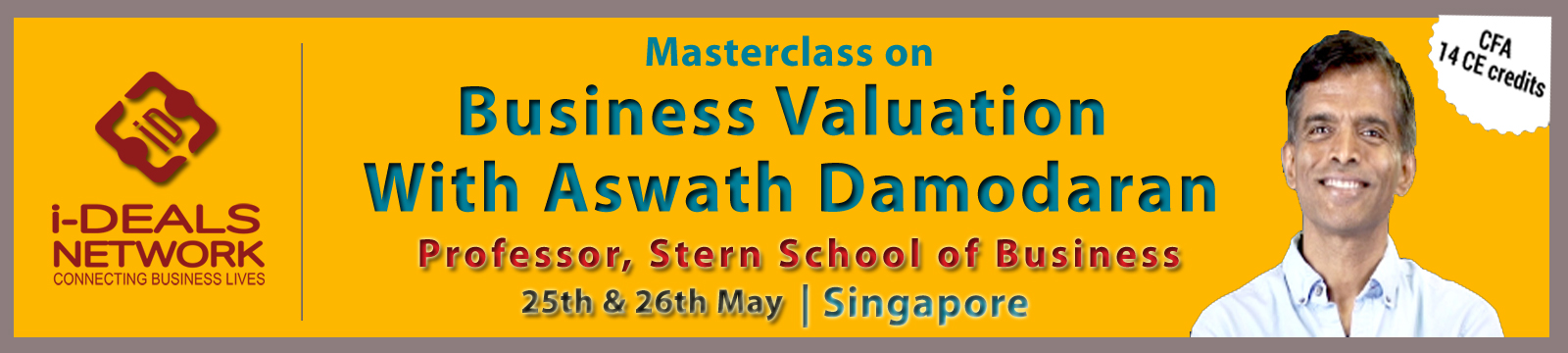

Meet Our Expert

Aswath Damodaran is the Kerschner Family Chair Professor of Finance at the Stern School of Business at New York University. He teaches the corporate finance and valuation courses in the MBA program. He received his MBA and Ph.D from the University of California at Los Angeles. His research interests lie in valuation, portfolio management and applied corporate finance. He has published in the Journal of Financial and Quantitative Analysis, the Journal of Finance, the Journal of Financial Economics and the Review of Financial Studies.

He has written four books on valuation (Damodaran on Valuation, Investment Valuation, The Dark Side of Valuation, The Little Book of Valuation), and two on corporate finance (Corporate Finance: Theory and Practice, Applied Corporate Finance: A User’s Manual). He has co – edited a book on investment management with Peter Bernstein (Investment Management), has a book on investment philosophies (Investment Philosophies) and one on “can’t miss” investment strategies, titled Investment Fables. He also has a book on the relationship between risk and value, Strategic Risk Taking, which takes a big picture view of how risk management affects value. Aswath was a visiting lecturer at the University of California, Berkeley, from 1984 to 1986, where he received the Earl Cheit Outstanding Teaching Award in 1985.

Agenda

-

Day 1

2018 May 25

-

Day 2

2018 May 26